All illustrations for this offer (which sees the policy fee waived permanently for the lifetime of an eligible policy) must be generated by 30-April 2024 and the application for that illustration must be submitted within 30-days of the illustration being generated.

We’re here for the long term good of New Zealand and this offer demonstrates significant long terms savings for customers over the life of a policy.

* Terms and Conditions apply.

With 70% of New Zealanders being under-insured, we’re focused on closing the protection gap so all New Zealanders can have meaningful and affordable access to advice and insurance.

How can I take advantage of the offer?

Simply generate an application as you normally would (either through E-App or paper application). Our New Business team will remove the policy fee of any eligible submissions during the offer period.

And to help you share this fantastic offer with your potential customers, we have included a promotional tool for you to use within your marketing channels.

Download marketing tools here.

If after completing the application you'd like to show the customer the total premium without the policy fee:

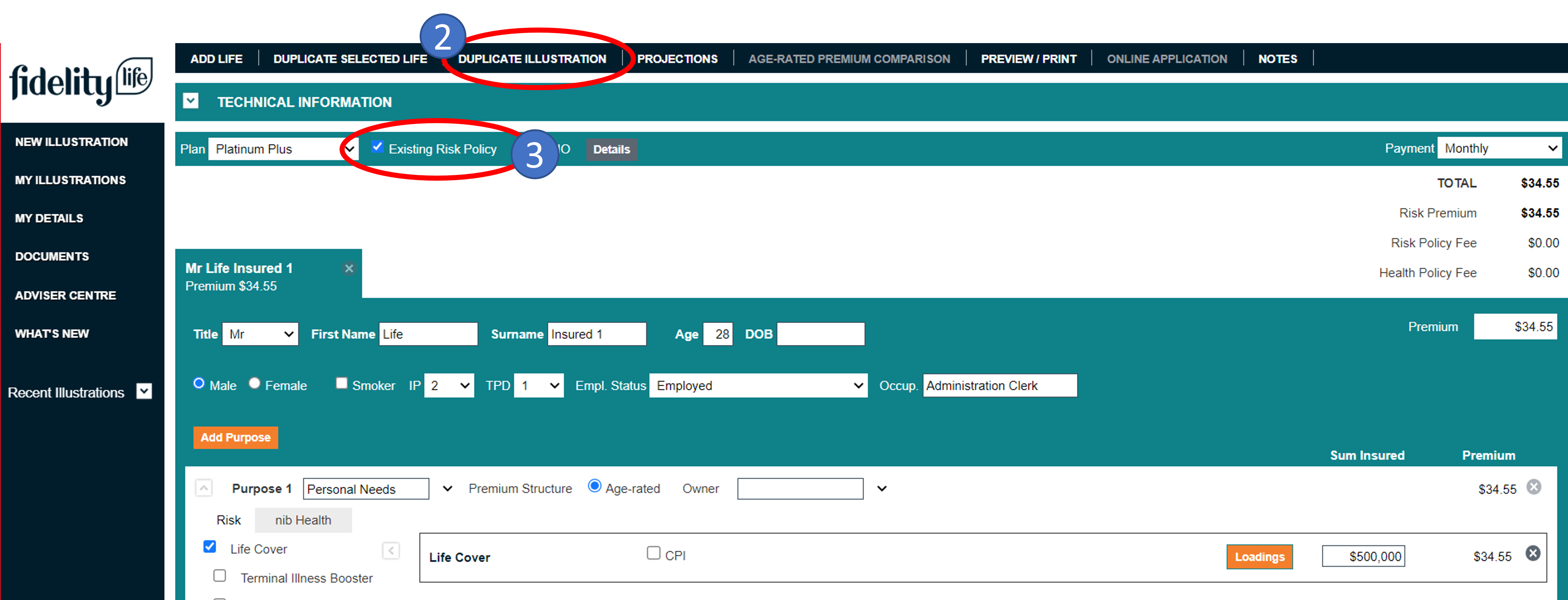

1) Open the client record in Apollo

2) Select Duplicate Illustration from the Navigation Bar

3) Select the Existing Risk Policy checkbox

^Disclaimer: The policy fee is based on Fidelity Life’s current annual policy fee for Platinum Plus which represents one policy for one life insured (only). The cumulative savings is calculated on the assumption the value will remain static across a ten-year term. The reference to premium is based on an average annualised premium figure (calculated on the assumption it is paid monthly and the value remains static over 10 years) and does not take into account an individual’s specific circumstances. The table is provided for convenience and informational purposes only and does not constitute a recommendation of any Fidelity Life products. Fidelity Life does not represent or otherwise warrant the accuracy or completeness of the information in this table. It should not be regarded as, or relied upon as being, comprehensive and should not be treated as a substitute for the terms and conditions of the relevant policies, benefits or offers. Fidelity Life accepts no responsibility for any loss, damage, liability or costs that arise from or in connection with an individual’s reliance on these figures.

Click here to view Terms & Conditions