What's changing?

From 1-April 2025, we’re increasing the underlying premium rates for existing business of our Life, Trauma, Total & permanent disability, Income and Mortgage protection-type covers.

The following applies:

5% price increase on Life, Trauma, Total and permanent disability, and Income and Mortgage protection-type covers where the benefit period has been selected is 5 years or less. This applies to:

- Platinum Plus (YRT), Mortgage Protector, Platinum (New Lumley), Lumley Life, Farmers' Mutual Life Ltd (FMLL) (Life assurance covers) and Protection covers.

7.5% increase applies to:

- Income or Mortgage protection-type covers with benefit periods to age 65 or 70 years.

Check out below for the full list of impacted covers.

Life covers will increase by 5% from 1-April 2025.

The underlying premium rates will increase for the following product covers – any covers not shown in the list below, are not having the change applied.

Which covers does this apply to?|

Product |

Cover types |

|

Fidelity |

Terminal Illness Accidental Death Life Assurance Family Protection |

|

Farmers' Mutual Life Ltd (FMLL) |

Life Assurance |

|

Platinum |

Life Assurance Survivors Income |

|

Lumley |

Death Benefit |

|

Platinum Plus (YRT), Mortgage Protector (where cover is available on the product) |

Life Assurance Survivors Income |

|

PRODUCT OPTIONS Platinum Plus (YRT), Mortgage Protector options (where cover is available on the product) |

Terminal Illness Booster |

Trauma type covers will increase by 5% from 1-April 2025.

The underlying premium rates will increase for the following product covers – any covers not shown in the list below, are not having the change applied.

Which covers does this apply to?|

Product |

Cover types |

|

Fidelity |

Family Income Plan (Trauma Accelerated Option) Life Care – Accelerated Trauma – Standalone Trauma – Accelerated |

|

Platinum |

Life Care – Accelerated Trauma – Standalone Trauma – Accelerated |

|

Lumley |

Trauma – Standalone Trauma – Accelerated |

|

Platinum Plus, Mortgage Protector (where cover is available on the product) |

Trauma Multi – Standalone Trauma – Standalone |

|

PRODUCT OPTIONS Platinum Plus (YRT), Mortgage Protector options (where cover is available on the product) |

Trauma Multi – Accelerated Survivors Income (Trauma Accelerated Option) Life Care – Accelerated Trauma – Accelerated |

|

Note: Where a cover also has the following options listed below, the premium for these options is calculated as a % of the main benefit premium rate. Although this % is not changing, the underlying premium rate is. This will result in an increase to these options and the other options mentioned below:

|

|

Income replacement covers will increase by 5%/7.5% from 1-April 2025.

(For disability covers ‘to age 65’ and ‘to age 70’ benefit periods the increase will be +7.5%).

Which covers does this apply to?|

Product |

Cover types |

|

Fidelity |

Income Protection – Indemnity Value Business Expenses Income Protection – Agreed Value Monthly Mortgage Repayment Key Person |

|

Platinum |

Income Protection – Indemnity Value Business Expenses Rural Key Person Defined Disability Income Key Person |

|

Lumley |

Income Protection – Indemnity Value Business Expenses Defined Disability Income |

|

Platinum Plus, Mortgage Protector (where cover is available on the product) |

Income Protection – Indemnity Value Business Expenses Rural Key Person Income Protection – Agreed Value Monthly Mortgage Repayment Defined Disability Income Key Person Retirement Protection |

|

PRODUCT OPTIONS Platinum Plus (YRT), Mortgage Protector options (where cover is available on the product) |

Income Protection – Agreed Value (Booster Option) Income Protection – Agreed Value (Claims Escalation Option) Income Protection – Agreed Value (Extended Option) Income Protection – Agreed Value (Extras Option) Income Protection – Indemnity Value (Booster Option) Income Protection – Indemnity Value (Claims Escalation Option) Income Protection – Indemnity Value (Extended Option) Income Protection – Indemnity Value (Extras Option) Monthly Mortgage Repayment (Booster Option) Monthly Mortgage Repayment (Claims Escalation Option) Monthly Mortgage Repayment (Extended Option) Monthly Mortgage Repayment (Extras Option) Retirement Protection on IP – Agreed Value (Claims Escalation Option) Retirement Protection on IP – Indemnity Value (Claims Escalation Option) Rural Key Person (Claims Escalation Option) |

|

Note: Where a cover also has the following options:

The premium for these options is calculated as a % of the main benefit premium rate. Although this % is not changing, the underlying premium rate is. This will result in some additional increase to premiums from these options and the other options mentioned above. |

|

Total and permanent disability type covers will increase by 5% from 1-April 2025.

Total and permanent disability type covers will increase by 5% from 1-April 2025.

Which covers does this apply to?|

Product |

Cover types |

|

Fidelity |

Mortgage Protector Family Income Plan (TPD Accelerated Option) TPD – Stand Alone TPD – Accelerated |

|

Platinum |

TPD – Standalone TPD – Accelerated |

|

Lumley |

TPD – Standalone TPD – Accelerated |

|

Platinum Plus, Mortgage Protector (where cover is available on the product) |

Mortgage Protector TPD – Standalone |

|

PRODUCT OPTIONS Platinum Plus (YRT), Mortgage Protector options (where cover is available on the product) |

Survivors Income – TPD TPD – Accelerated |

|

Note: Where a cover also has the following options: Life Buyback Option. The premium for these options is calculated as a % of the main benefit premium rate. Although this % is not changing, the underlying premium rate is. This will result in some additional increase to premiums from these options and the other options mentioned above. |

|

Waiver of premium (WOP) covers will increase by 5% from 1-April 2025.

Which covers does this apply to?|

Product |

Cover types |

|

Fidelity |

Waiver of Premium |

|

Platinum |

Waiver of Premium |

|

Platinum Plus |

Waiver of Premium |

Why our pricing stands out.

We have remained committed to offering competitive pricing over the years, ensuring our customers receive value for their cover. Unlike many in the market, we have resisted implementing significant price increases, maintaining stability and fairness to our customers. This commitment has allowed us to absorb rising costs for as long as possible, delaying the need for price adjustments. However, due to rising claims costs, and our claims costs also increasing in the past 5 years we must make pricing increases to ensure we can continue to deliver on our promise at claims time.

Claims costs review.

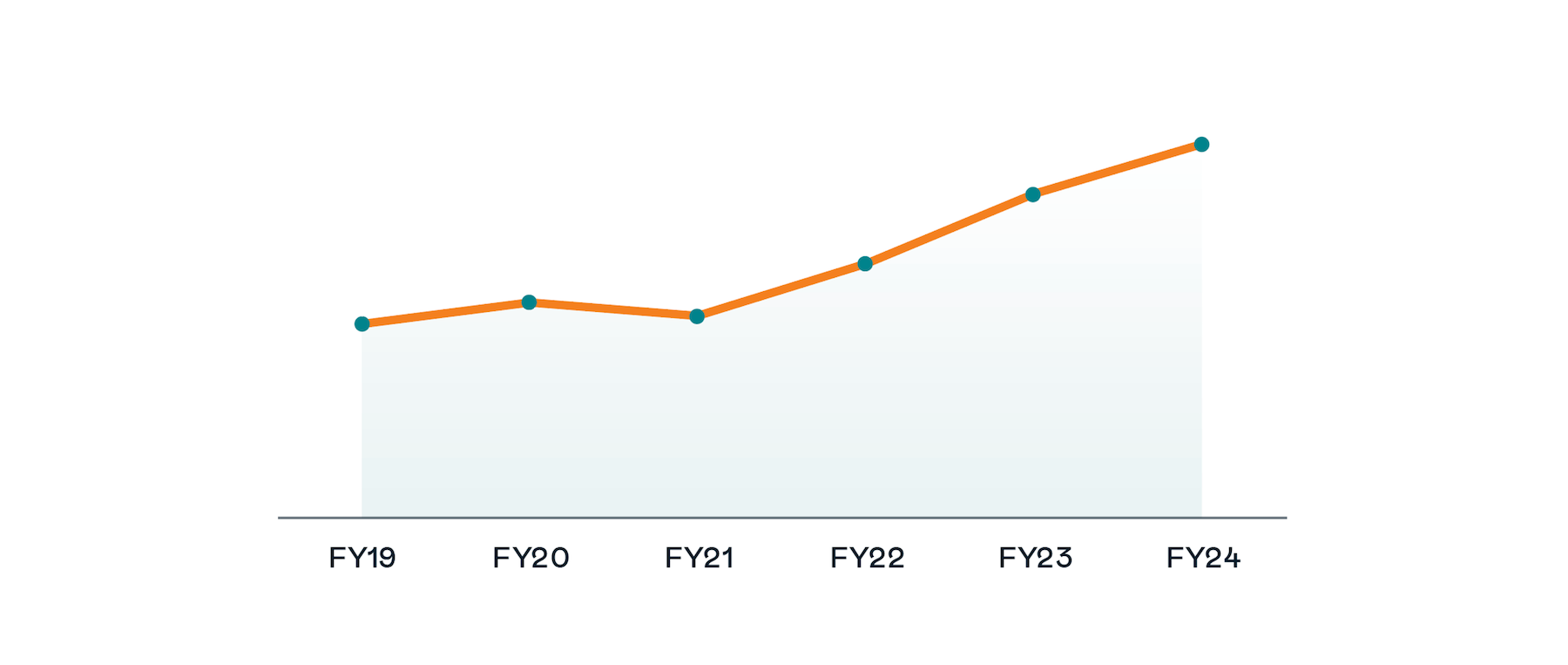

The below shows the increase on claims costs to Fidelity Life from 2019 to 2024.

Source: Fidelity Life Annual Report, Cost of claims paid out FY2019 to FY2024.

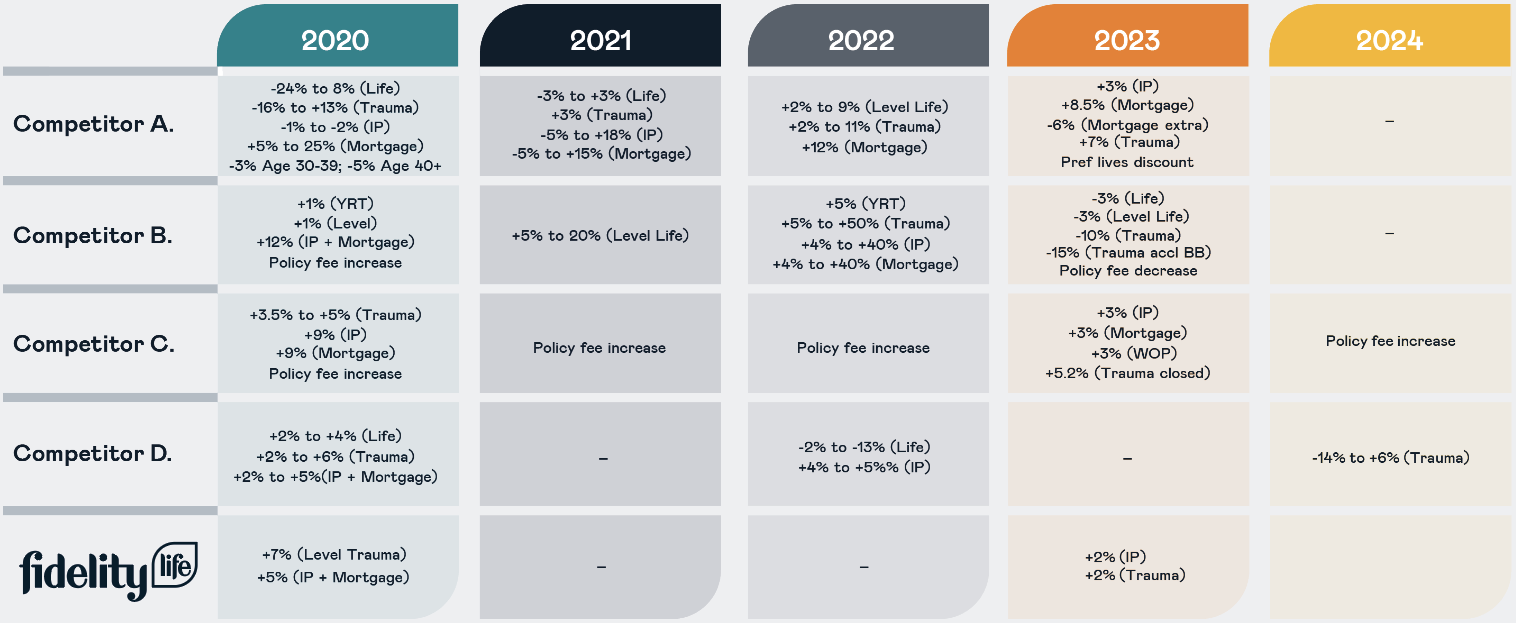

Price increase review.

The below is sourced from Chatswood Consulting Jan-2025, shows price increases across the market from 2020 to 2024, illustrating that we have maintained competitive pricing and adopted a more measured approach to price adjustments in the past years.

Keeping customers informed: Understanding their new premium and available support.

Helping you in your conversations with customers.

We’ve put together a handy resource guide for you, to help your conversations with customers. This guide will help explain the price increase, showcase key talking points with customers, and reinforce the adviser tools available to support customers who may be impacted.

How we're communicating to customers.

- New premiums will be reflected in renewal letters of affected customers for policies renewing from 1-April 2025.

- Customers will start to receive their renewal letters 6-weeks prior to renewal. This will come into effect from 18-February 2025.

Item 3.

- Some customers will receive a flyer insert with their renewal letters 6-weeks prior to renewal. This will come into effect from 18-February 2025.

Helpful resources.

The below articles help customers understand why prices are increasing, how this affects their policy and the options available to them.

Struggling with your premium?

Help customers understand their options and what help is available from you and our Customer care team.

Read more.Why premiums increase.

Help explain why insurance premium increases are necessary, especially in the current economic climate.

Read more.Additional support we may be able to provide.

Some of our products have built in hardship provisions, including premium holiday and leave without pay options. We can also offer 90 days’ premium relief, to help customers facing financial hardship keep their policies in place through a premium deferral while they get back on their feet. In addition, our Customer care team can help customers make up missed payments, reinstate cover or apply a premium freeze or temporary hold.

Some of our covers have built-in provisions to support customers dealing with financial difficulties. These include:

- Premium holiday option – up to 12 months on select Life, Survivor’s Income and TPD covers

- Leave without pay option- up to 12 months on select Income Protection and Monthly Mortgage Repayment covers

- 90 days’ premium relief - to help customers facing financial hardship while keeping their policies in place through a premium deferral while they get back on their feet.

We're here to help.

On a case-by-case basis our Customer care team can help customers with making up missed payments, reinstating cover or a premium freeze or temporary hold.

For further information, reach out to your Business manager. To discuss support options available for customers or for any alterations, our Customer care team can help - call 0800 88 22 88. Our team are here to support in every way we can.

Frequently asked questions.

-

From 1-April 2025, we’re increasing the underlying premium rates for existing customers of our Life, Trauma, Total & permanent disability, Income and Mortgage protection-type covers, by 5% and 7.5%.

The following applies:

5% price increase on Life, Trauma, Total and permanent disability, and Income and Mortgage protection-type covers where the benefit period has been selected is 5 years or less. This applies to:

- Platinum Plus (YRT), Mortgage Protector, Platinum (New Lumley), Lumley Life, Farmers' Mutual Life Ltd (FMLL) (Life assurance covers) and Protection covers.

7.5% increase applies to:

- Income or Mortgage protection-type covers with benefit periods to age 65 or 70 years.

View above for the full list of impacted covers.

-

Over the years, we have remained committed to offering competitive pricing to provide value for our customers. Unlike many in the market, we have resisted implementing significant price increases, maintaining stability and fairness.

The last time we updated our rates was in June 2023 when we increased premiums for our Trauma and Income covers by 2%. We last increased premiums for Life cover in 2018 (6.3%).

We have worked to absorb rising costs wherever possible, delaying the need for pricing adjustments however, as claims costs increase, we now must adapt and increase our prices.

-

We are committed to fair and stable pricing. The last time we updated our rates was last June 2023, of a 2% increase to premiums for our Trauma & Income covers.

-

The new premiums will be reflected in affected customers’ renewal letters for policies renewing from 1-April 2025 – these are being sent as usual, 6-weeks in advance, from 18-February 2025.

Premium increases often lead to customer discussions about affordability and needs. To ensure that customers receive meaningful advice that considers their circumstances, these discussions are best had by financial advisers.

We’re focusing on helping you; to understand these changes so you’re equipped to answer customer questions.

-

We encourage customers to seek financial advice that considers their circumstances, affordability and needs.

After that, it depends on their individual circumstances and you’re in the best position to advise them of their options. We offer financial hardship options – for more details contact our Customer care team on 0800 88 22 88.

For any alterations to cover, contact our Custmer care team on 0800 88 22 88.