Great news! We've extended our 3-month premium free offer until 31-December 2024.

This offer applies to all eligible Platinum Plus, Platinum Plus Level Term, Mortgage Protector and NZHL Life policies that are:

-

illustrated between 1-May until 31-December 2024 and

-

applications are submitted within 30-days of the illustrations being generated and

-

a policy is issued within the 6 months of the offer period end date.

*Terms & Conditions apply.

Will this waiver be displayed on Apollo?

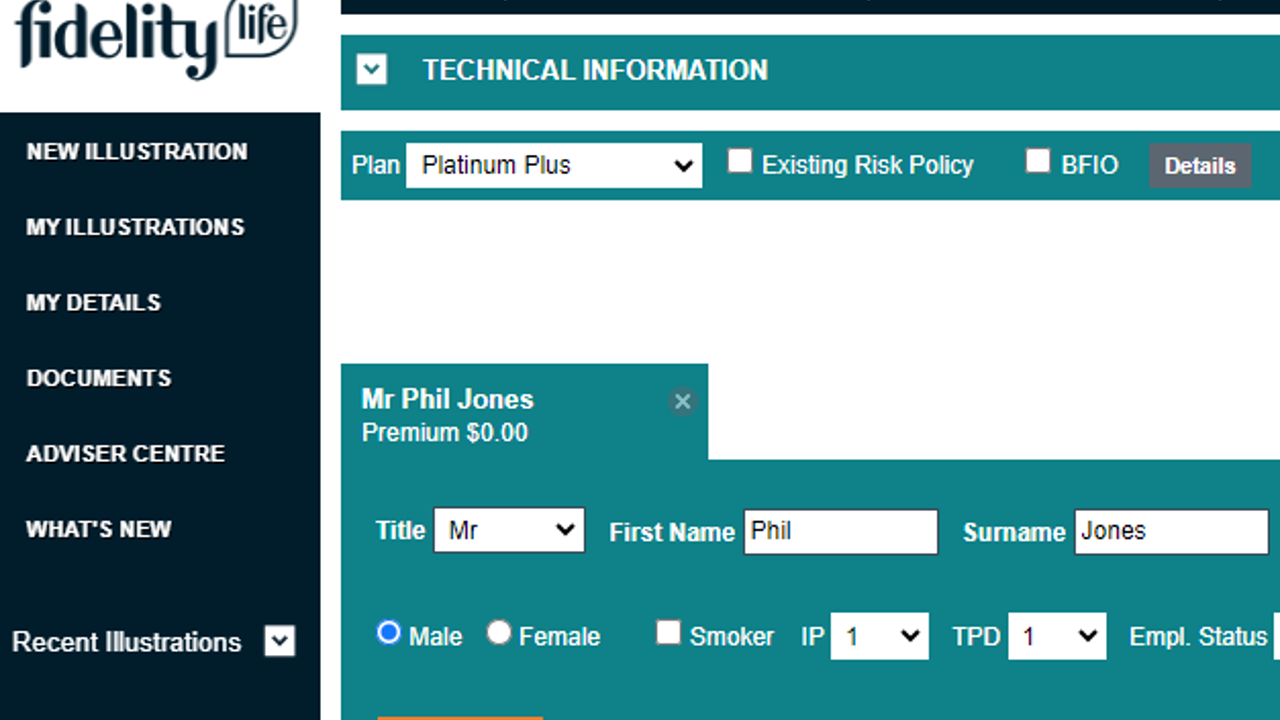

When creating an illustration for a customer, Apollo will not show the 3–months waiver.

So, we’ve created a digital flyer with all the information your customer will need about this offer.

The 3-months premium free will also be clearly communicated in the customer’s welcome letter once their policy is in-force.

Promotional tools for you to use.

Customer facing flyer.

Show this flyer to your customers to explain how the 3-month waiver will work for their choice of premium payments.

Social media post and web tile.

Download this tile and social media post and pop onto your Linkedin profile to let people know of this great offer.

Frequently Asked Questions.

-

The offer is available to new policies only purchased on any qualifying product.

-

The offer is available on Platinum Plus, Platinum Plus Level Term, Mortgage Protector and New Zealand Home Loan Life products only.

-

The offer period for the promotion is from 1-May 2024 and ends 31-December 2024. Any illustrations that are created during this period and submitted within 30-days of their generation are eligible. This means that the last date for generating eligible illustrations is 31-December 2024, and the deadline for submitting eligible applications is 30-January 2025. The policy must also be issued within six months of the end of the offer period, with the last policy issuance date for the offer being 30-June 2025.

-

In all cases, an amount equivalent to three months’ premiums will be credited to the eligible policy. The three month period will be calculated from the date of policy issuance and will be applied to the policy's premium payments based on the selected payment frequency. This means that:

- For monthly payments, the first 3 regular premiums will be waived.

- For fortnightly payments, the first 6 and a half regular payments will be waived, which means the first payment the customer makes will be reduced by half.

- For quarterly payments, the first payment will be waived.

- For half-yearly payments, half of the first payment will be waived.

- For annual payments, one quarter of the annual payment will be waived.

-

Yes.

-

Yes.

-

Yes.

-

If the customer has not paid a premium there is no refund due to them for cancellation within the free look period. If a customer has paid a premium in advance i.e., half yearly, annually, the applicable customer paid premium will be refunded only. For all customers the free premium amount cannot be refunded or exchanged for cash.

-

If a customer makes changes to their policy during the 3-month free period, the new premium amount will apply from the date of the alteration and credited until the end of the issued 3-month free period. For example, if a policy is issued on 30-May and an alteration is made on 15-July, then the original premium credit applies up to 15-July, then the adjusted premium will apply until 30-August.

-

The offer does not include reinstatement of a policy or cover. The replacement of any existing policy currently with Fidelity Life is not included in the offer. Any changes made to an existing policy such as adding a cover, increasing cover, or adding a person are not included.

-

Yes

-

No.

-

No. A flyer will be supplied to help you communicate the offer to your clients. The flyer will show how the three months premium free is calculated based on each payment frequency.

-

No. If the policy cancels within the premium free period for reasons other than death, then the commission writeback process applies as normal.