The Conduct of Financial Institutions (CoFI) regime comes into effect on 31 March 2025. Below are some FAQs which cover important information about what this means for you as advisers, for Fidelity Life and for our customers.

We encourage you to review this information carefully and reach out if you have any questions. Our Conduct team and Business managers are here to assist you.

Find out more.

-

Following a review of conduct and culture across the financial services industry in 2018 by the Financial Markets Authority (FMA) and the Reserve Bank of NZ (RBNZ), a new conduct licensing regime was created through the Financial Markets (Conduct of Institutions) Amendment Act 2022, often referred to as "CoFI".

CoFI introduces a ‘fair conduct principle’ from 31 March 2025 for financial institutions like Fidelity Life to treat customers* fairly. It requires us to have and maintain an effective fair conduct programme (FCP), comply with our FCP and for us and our intermediaries to comply with regulations about incentives.

In order for us to continue providing our products and services, we are required to hold a ‘financial institution licence’ from 31 March 2025. We were granted our licence by the FMA in November 2024.

*When we talk about our ‘customers’, this includes people who receive the benefit of a group life insurance policy.

-

The fair conduct principle is that a financial institution must treat its customers fairly.

The requirement to treat customers fairly includes:

- paying due regard to customers' interests;

- acting ethically, transparently, and in good faith;

- assisting customers to make informed decisions;

- ensuring that the relevant services and associated products provided by the financial institution are likely to meet the requirements and objectives of likely customers (when viewed as a group); and

- not subjecting customers to unfair pressure, tactics, or undue influence.

-

The fair conduct principle applies when a financial institution—

- is designing any relevant service or any associated product; or

- offers to provide any relevant service or any associated product to a customer; or

- provides any relevant service or any associated product to a customer; or

- has any dealings or interactions with a customer in connection with any relevant service or any associated product (for example, responding to a complaint or handling a claim under an insurance contract).

The fair conduct principle also applies to a financial institution when an intermediary is involved in the provision of any of the financial institution’s relevant services or associated products to a customer. -

Fidelity Life has been working towards readiness for the CoFI regime for more than two years, including extensive review and uplift across all areas of the business of our policies, processes, systems and controls to ensure we are treating our customers fairly. We have simplified, clarified, implemented and improved across all aspects of our operations that might impact our customers – from our development and review of products, consideration of how we distribute our products, identification and remedy of conduct-related issues impacting customers, to the way we communicate. This is summarised in our FCP.

-

CoFI requires financial institutions to make certain information about their FCP publicly available. A summary of key matters of our FCP will shortly be available on our website, along with a download button should a copy be required. We encourage you to refer your customers to this information.

-

All registered banks, licenced insurers and non-bank deposit takers providing relevant services to customers require a financial institution licence. We were granted our licence from the FMA in November 2024.

-

We have a Conduct team that works across Fidelity Life to keep an eye on all aspects of the products and services we make available to customers. This includes overseeing compliance with conduct expectations / obligations of both our internal stakeholders and intermediaries. By continually reviewing our procedures, products, tools and services, and the activities of our distribution and administration channels, the Conduct team ensures any matters that might unfairly impact customers are being addressed.

-

Although the CoFI regime and the requirement to hold a licence applies to financial institutions, as our intermediary, you play a crucial role in connecting with our shared customers. It's important that we work together to ensure fairness for our customers.

As a financial adviser, FAP, or Authorised Body you will already have policies, processes and controls in place to comply with your own conduct obligations under the FAP licence conditions, the Code of Professional Conduct for Financial Advice Services, and your distribution arrangements with Fidelity Life.

We are not looking to introduce any new requirements at this time around the way you work with Fidelity Life. We run a comprehensive intermediary monitoring and oversight approach which will continue.

-

If you or your customers believe a product or service provided by Fidelity Life has treated an individual customer unfairly, let us know via the usual channels. Refer to the Making a complaint page on our website for details.

If any complaint or allegation has been made about you, your FAP or Authorised Body that could impact our shared customers, per your Fidelity Life Distribution Agreement please report such issues to your Business manager or contact our Conduct team at conduct@fidelitylife.co.nz. For example, any:

- Complaints or allegations about your financial advice services

- Investigations or sanctions by the FMA, your Dispute Resolution Scheme or any other authority.

-

CoFI imposes an obligation not only on insurers but also on our intermediaries (i.e. you and your staff) to comply with the Financial Markets Conduct (Conduct of Institutions) Amendment Regulations 2023 (referred to as the “Incentive Regulations”). Broadly speaking, these regulations prohibit target-based volume or value incentives being offered to customer facing staff and their managers. It’s important that you understand and consider any impact the Incentive Regulations may have on yourself and/or your business. We recommend you seek appropriate legal advice. More information can also be found on the FMA’s website at https://www.fma.govt.nz/business/services/financial-institutions/sales-incentive-faqs/.

-

We are unable to offer advice to anyone on whether particular incentives are prohibited under the Regulations and recommend that you seek appropriate legal advice if unsure.

-

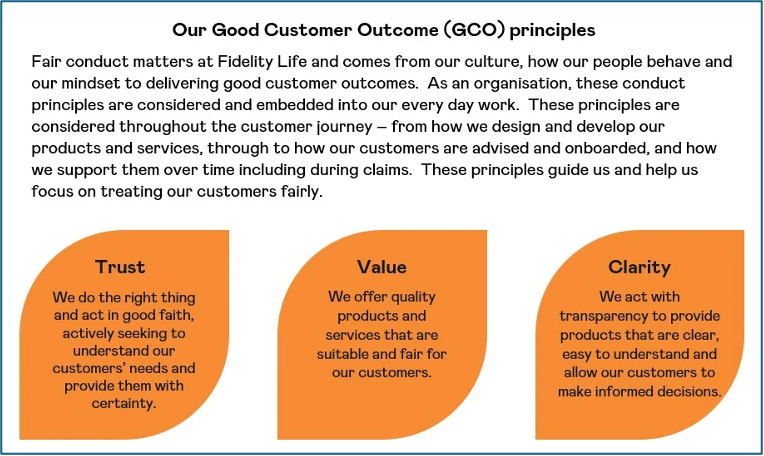

Very much so! To ensure that we keep our customers at the heart of everything we do, Fidelity Life has a set of Good Customer Outcome principles. These principles help guide us on understanding what it means to treat customers fairly and ensure that we also comply with CoFI's fair conduct principle. Our Good Customer Outcome principles, as a key component of our FCP, apply across all aspects of the customer journey lifecycle.

-

If you have any other questions that are not already covered in these FAQs regarding CoFI, conduct, or Fidelity Life’s Fair Conduct Programme please contact your Business manager, or our Conduct team at conduct@fidelitylife.co.nz.

-

Yes. To comply with our CoFI obligations, from 28-March 2025 the Initial Commission Rate (as defined in your Distribution Agreement) will no longer be determined by reference to performance against the Commission Scorecard as set out in the Commission Schedule. Instead, your Initial Commission Rate will be set as the commission rate applied by Fidelity Life under your Distribution Agreement immediately before 28-March 2025. To give effect to this, we have varied your Distribution Agreement, which we notified you of by email on 28-March 2025. Please refer to that email for a copy of the variation.

This change is necessary because, under CoFI, we cannot offer a rate of commission that is calculated by reference to any volume or value-based targets, for example persistency rates or in force policy count which appeared in the Commission Scorecard.